The SIMPLE Framework

To evaluate early stage startups

How do you evaluate early-stage startups? I’m talking early. Seed & Series A.

Some fail, go sideways, and few become extremely successful. The latter can be the most rewarding experience of your career.

I've been fortunate to be a part of 2:

Acquia (15th employee. $1B exit) and Snyk (80-something employee. 2024/2025 IPO candidate). The other 4 Series A startups: 1 got acquired quickly, 1 made a pivot, and 2 are still in their early days. Learned a ton at each one!

Some of it is luck. Some of it is evaluating the right characteristics.

I use the SIMPLE framework to:

Evaluate the company that I’m

Looking to join.

Considering an angel investment.

Formulate better interview questions.

Reversely, Founders, GTM leaders, and recruiters can use the framework to tell a more compelling story to attract & hire better candidates.

The SIMPLE framework is not exhaustive - but covers the key points and is hopefully easy to remember.

In this post we’ll go over:

The SIMPLE Framework

The Characteristics

The Questions to Ask

This is part 2 of my Ultimate Sales Interview Playbook:

[This Post] A framework to evaluate startups

Questions from 50+ interviews (upcoming)

Challenges & homework assignments with templates (upcoming)

Strategies to standout & drive urgency (upcoming)

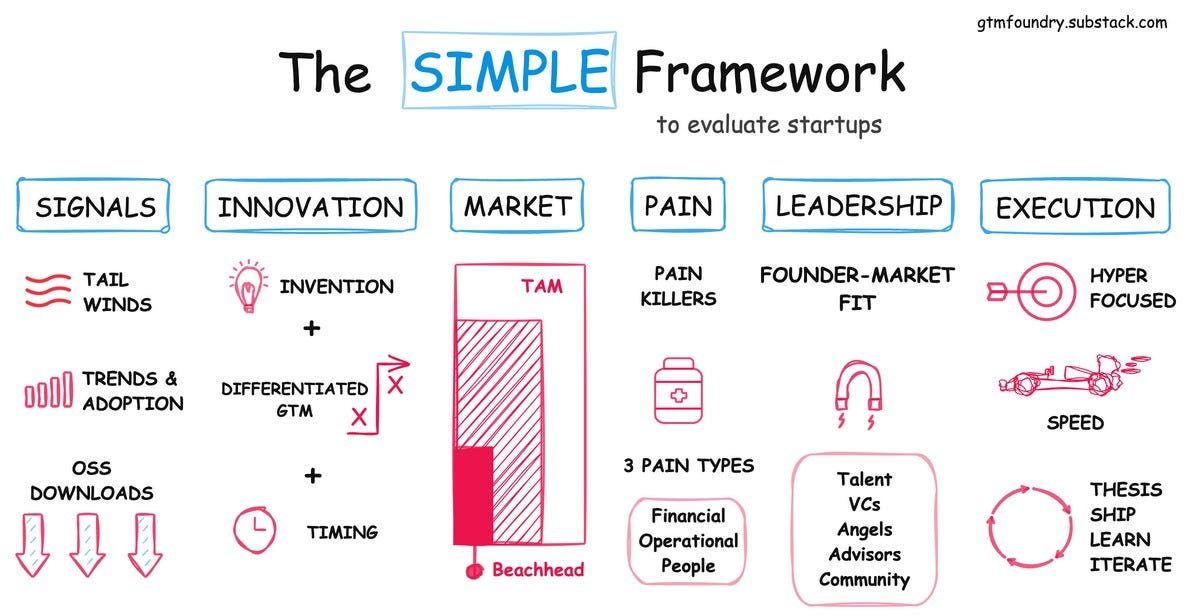

The SIMPLE Framework

S.I.M.P.L.E. stands for:

Signals - Early signs of traction.

Innovation - A differentiated product & GTM approach.

Market - Beachhead and size of market opportunity.

Problem - How painful the problem is.

Leadership - Founder-Market-Fit, investors, supporting circle.

Execution - Signs they are delivering on their vision.

Inspecting each area gives you a better idea of the likelihood of success.

The Characteristics

You’re ultimately trying to find a company that has the right ingredients that optimize chances of success. Let’s dive into each one:

Signals

Revenue & growth are the true north stars.

However, if you are going in early (Seed / Series A), there’s not much data (or revenue) to go on.

So you need to look at other signals. There are many, but here are some examples:

Adoption:

Users

Downloads

MAU (monthly active users)

GitHub stars (for open-source projects)

Initial community.

Investors

Have they attracted funding from Tier 1 VCs

The caliber of angel investors & advisers

Tail/Head Winds

What market conditions help you to sell

What market conditions make selling harder

Talent

Where did execs come from?

Questions to Ask

Where are you seeing the most traction & why?

What signals are you seeing that you have found Product-Market-Fit or on the path to it?

How do you know customers are realizing value in your product?

Innovation

Innovation is more than just technology invention.

Today, it is harder to differentiate and build defensibility with technology alone.

True innovation is coming a differentiated product with a differentiate GTM strategy (think distribution, too) with the right timing.

Tomasz Tunguz, a Venture Capitalist at Theory, shared a formula for innovation in one of his blog posts:

Innovation = Invention + Go To Market + Timing

Timing is hard to assess, but you can come up with some hypotheses about why timing is good. This also goes back to headwinds and tailwinds.

Companies may not have defensibility from day 1.

They do need a plan to build it over time.

Market

Marc Andreesen says this is the only thing that matters (when compared to Team & Product, the obvious ones).

In a great market—a market with lots of real potential customers—the market pulls product out of the startup.

The market needs to be fulfilled and the market will be fulfilled, by the first viable product that comes along.

The product doesn’t need to be great; it just has to basically work. And, the market doesn’t care how good the team is, as long as the team can produce that viable product.

In short, customers are knocking down your door to get the product; the main goal is to actually answer the phone and respond to all the emails from people who want to buy.

And when you have a great market, the team is remarkably easy to upgrade on the fly.

How I think about it:

Total Addressable Market (TAM) - Total market.

Serviceable Available Market (SAM) - Where you can expand.

By adding product.

Tangential markets.

Service Obtainable Market (SOM) - Who you can sell to now,

Outside of your EVG.

Your beachhead.

Earlyvangelists (EVG) - Family, VC intros, your earliest adopters from your network.

Questions to Ask

How are you differentiating your GTM approach to break through the noise in the market?

What tailwinds are you feeling that signals the timing is right for you?

What is your beachhead & how do you expand?

Problem

Painkiller or vitamin.

This market is all about must-haves (the painkillers).

The MEDDICC framework has a good way to think about pain. Enterprises have 3 types. What type of pain is the startup alleviating?

Financial Pain

High operational costs

Revenue losses or stagnation

Inefficient capital allocation

High customer acquisition costs

Regulatory compliance costs

Efficiency Pain

Process inefficiencies

Inadequate data management & utilization

Engineering inefficiencies (too much time fixing bugs)

Technology gaps

GTM inefficiency

People Pain

Recruitment & retention challenges

Lack of team collaboration

Communication breakdowns

Employee disengagement

Skills & training deficits

How does the solution solve one, two, or all of these?

Questions to Ask

What customer metrics do you help improve?

What happens if the customer doesn’t improve those metrics?

How do you make the business case for your solution?

Leadership

There are 3 groups of leaders to look at:

Founders - Is there “Founder-Market-Fit”?

Executive team - Have they scaled similar companies before?

Investors - Are they specialists in the specific domain?

These could be VCs or Angel Investors.

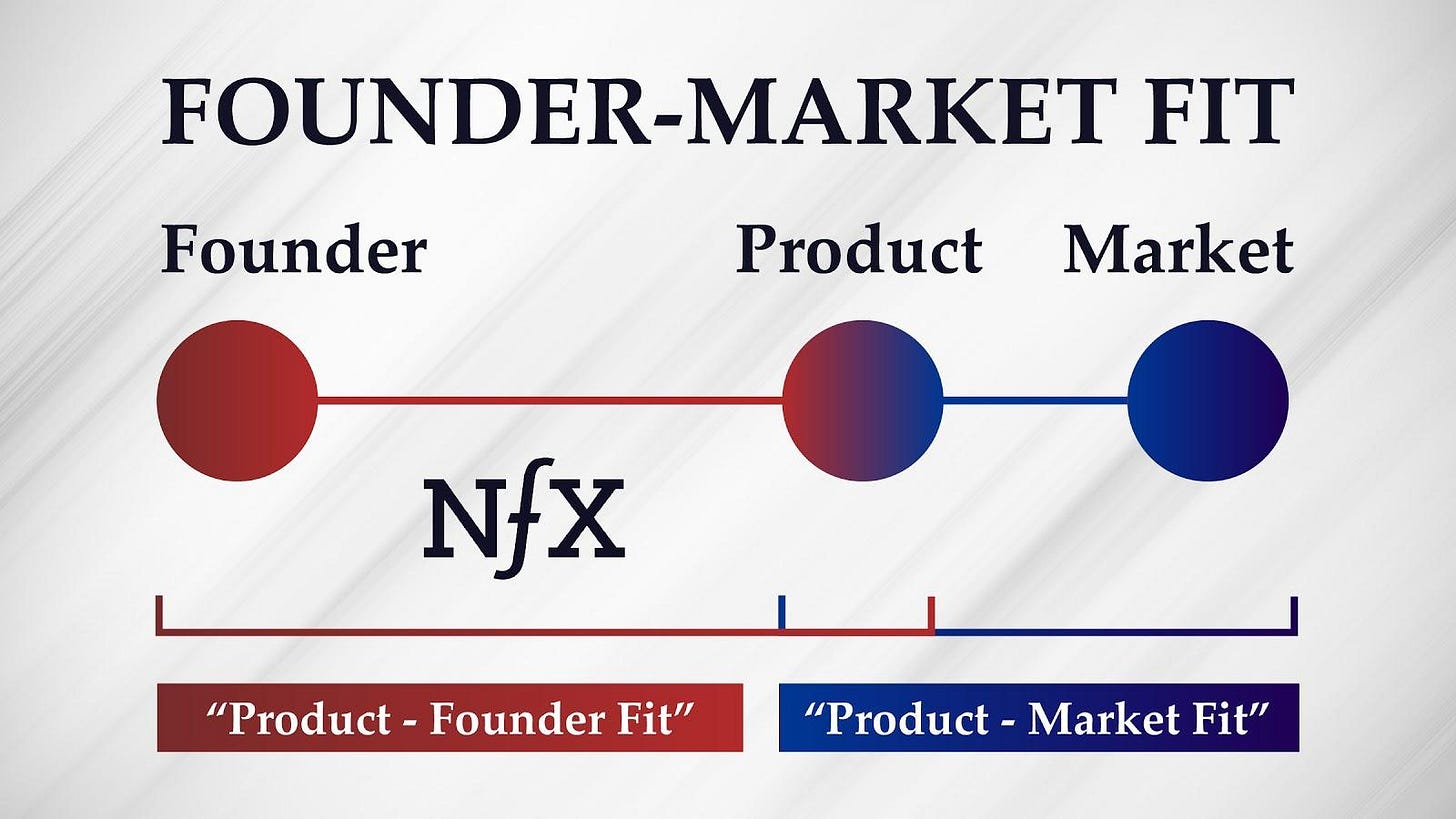

NfX - a Venture Capital firm that focuses on network effects has a nice framework to think about Founder-Market-Fit:

Obsession

Iconic companies almost always have obsessive Founders at the helm.

A sign of health obsession is knowledge.

They are a student of the market: trends, competition, why previous companies failed, etc.

Founder Story

“Customers have to identify with the Founder’s story and believe that there’s a compelling “why” inside the Founder - that there’s a human behind the company.

Personality

Markets attract similar personalities. Does the Founder’s personality fit in?

Experience

Industry experience, but not too much. Too much might mean they don’t have any disruption left in them.

Questions to Ask

What’s the story behind why you’re building this product?

What market or customer insights are you leveraging to build your product/company?

How are you becoming a thought leader in your category?

Execution

“Execution is everything.” John Doerr

Sam Altman thinks about execution and evaluating execution in the following way:

Execution gets divided into two key questions. One, can you figure out what to do and two, can you get it done. So I want to talk about two parts of getting it done, assuming that you’ve already figured out what to do. And those are focus and intensity. So focus is critical. One of my favorite questions to ask founders about what they’re spending their time and their money on. This reveals almost everything about what founders think is important. - Sam Altman

A sign of good execution is progress.

You can measure progress with metrics.

The actual metrics and results against those metrics can tell you a lot about:

What the company is focused on.

Are they making progress toward hitting those goals?

How do you really know they are finding PMF.

How fast are they learning, iterating, and shipping?

Questions to Ask:

How do you know your strategy is working?

What metrics are you using to track success?

What’s holding you back from growing faster?

🤞🏼That’s a wrap.

Next up in the Ultimate Sales Interview Playbook:

Questions from 50+ interviews (steal and use for either side of the table)

Challenges & homework assignments with templates

Strategies to standout & drive urgency